Finding multiple capital sources to finance several properties can prove challenging for real estate investors looking to grow their rental investment portfolio. Each individual loan brings time-consuming underwriting processes, unique requirements, and growing logistical servicing headaches. And, that’s not to mention the evolving rental regulatory challenges investors are already tasked to navigate.

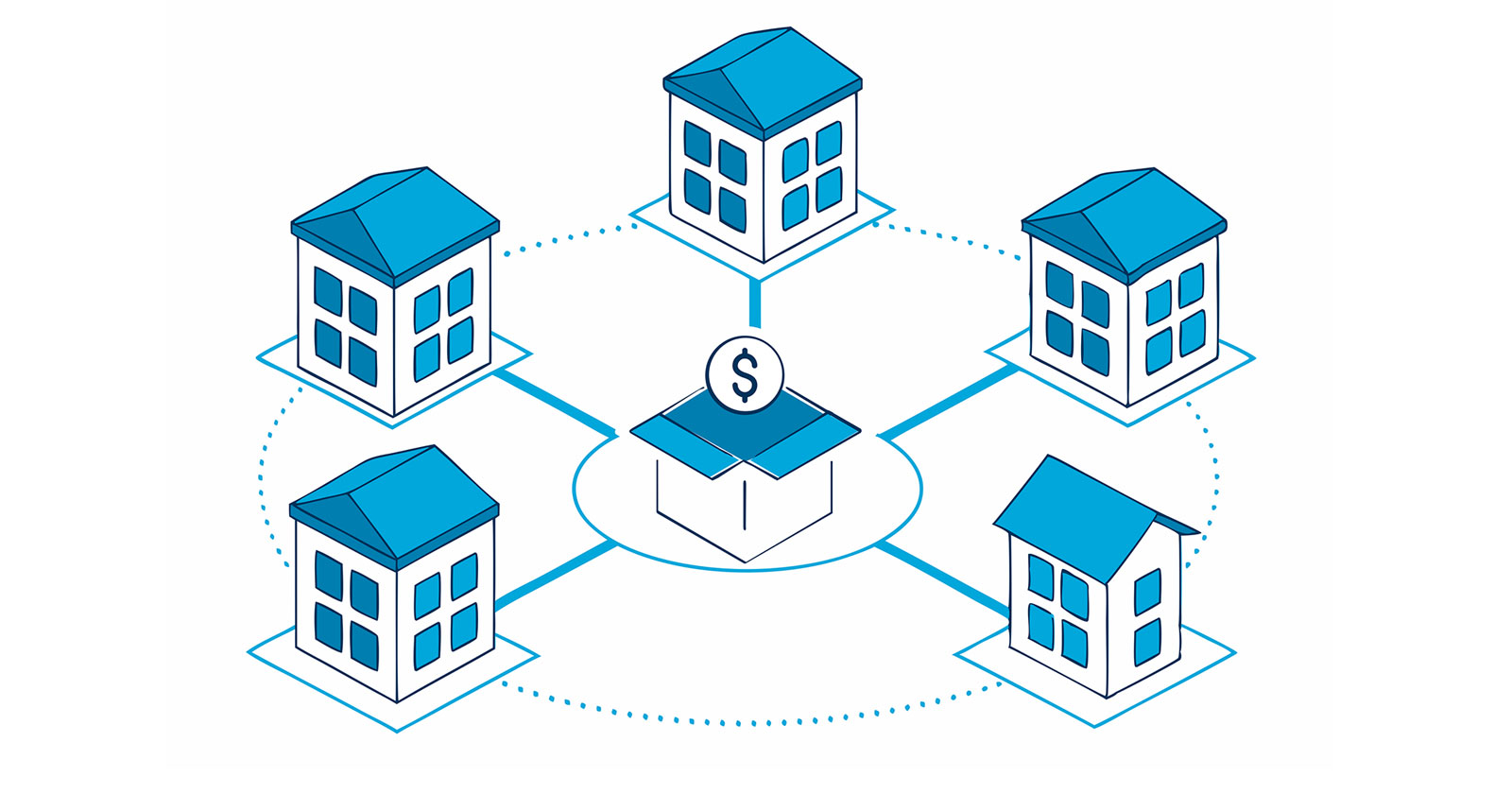

That is why savvy rental investors leverage rental portfolio loans, or blanket loans, to cross-collateralize assets and simplify the purchasing, renovating, and renting of various rental properties.

But what are blanket loans for real estate investors, and how do they work?

Below, we’ll provide a blanket loan definition, discuss when and how to utilize them, and provide common blanket loan requirements.

That is why savvy rental investors leverage rental portfolio loans, or blanket loans, to cross-collateralize assets and simplify the purchasing, renovating, and renting of various rental properties.

But what are blanket loans for real estate investors, and how do they work?

Below, we’ll provide a blanket loan definition, discuss when and how to utilize them, and provide common blanket loan requirements.

What is a Blanket Loan?

A blanket loan in real estate is offered through private lenders and is designed to meet the needs of ambitious investors looking to expand their rental portfolio. Rather than working with various lenders, investors work with a single real estate investment lender to combine each investment loan under one umbrella with a single monthly payment.

This simplifies loan processing and logistics for investors and gives lenders greater flexibility over loan terms and conditions. With more freedom, private lenders can tailor packages that cater to their client’s unique needs.

While blanket loans for rental investments focus mainly on the asset (property) over the borrower, lenders are taking a greater risk financing multiple long-term properties at once. That is why rental portfolio loans often come with certain requirements, including:

This simplifies loan processing and logistics for investors and gives lenders greater flexibility over loan terms and conditions. With more freedom, private lenders can tailor packages that cater to their client’s unique needs.

While blanket loans for rental investments focus mainly on the asset (property) over the borrower, lenders are taking a greater risk financing multiple long-term properties at once. That is why rental portfolio loans often come with certain requirements, including:

- 660 FICO score or above

- Minimum occupancy rate of 90%

Blanket loans can be refinanced and typically include a release clause allowing borrowers to sell a property from the group of investments while maintaining the loan. This enables investors to sell certain properties if their business plan changes or an investment is underperforming.

The Benefits of Blanket Loans for Rental Property Financing

Once an investor goes from owning one or two single units to a portfolio it’s high time to cash in on the benefits of packaging mortgages into blanket loans, including:

Streamlined Loan Underwriting & Approval

Rental portfolio blanket loans are asset-based (takes a property’s current and/or potential cash-flow into consideration) rather than borrower-based. Instead of harping on tax filings and personal income verification, private lenders focus on property-specific documentation to determine the current and potential cash flow and cost basis of the investment properties.

In most cases for blanket loan applications, private lenders only require:

In most cases for blanket loan applications, private lenders only require:

- Two to three months of bank statements showing 3 to 6 months of liquid reserves to cover debts in the case of vacancy, turnover, etc.

- Occupant lease(s) (if applicable)

- Insurance (property, flood, tornado, fire, liability, etc.)

- Renovation documentation–receipts, invoices, or work orders regarding any rehabilitation work on the property.

By eliminating tax return requirements, investors are able to avoid tax write-off penalties. Additionally, the consolidation of multiple properties under one loan through a single lender makes underwriting easier for lenders–creating streamlined and faster approval processes for their clients.

Less Property & Capital Limitations

Thanks to strict guidelines and stringent governmental oversight, traditional lenders, like banks and credit unions, must limit the number of investments or capital a single borrower can receive. Additionally, conventional lenders are less flexible with the type of property a borrower can purchase. They require properties to meet “minimum conditions” to be loan-eligible. Luckily for scaling investors, this is not the case for blanket loans through private lenders!

By operating outside of governmental and institutional bureaucracy, private lenders have the freedom and flexibility to provide much higher caps on the number of loans, properties, and dollar amounts a borrower is eligible to receive. In addition, most rental portfolio loan lenders will finance C4 or better condition properties, so long as there is no deferred maintenance. This allows investors to invest in lower-cost, high-ROI properties, and a variety of property types, including:

By operating outside of governmental and institutional bureaucracy, private lenders have the freedom and flexibility to provide much higher caps on the number of loans, properties, and dollar amounts a borrower is eligible to receive. In addition, most rental portfolio loan lenders will finance C4 or better condition properties, so long as there is no deferred maintenance. This allows investors to invest in lower-cost, high-ROI properties, and a variety of property types, including:

- Single-family residences (SFR)

- 2-4 unit properties

- Warrantable condos

- Townhomes

- PUD

Greater Leverage & Flexibility

As mentioned, private lenders focus on the asset rather than the individual during loan origination. Not only does this create more avenues for lenders to say yes, but it also gives investors more leverage during negotiations because of a property’s LTV (loan-to-value), LTC (loan-to-costs), and DSCR (debt-service-coverage-ration) considerations.

Metric | Description |

LTV | Compares loan amount to property’s current market value |

LTC | Compares loan amount to the estimated total project costs. |

DSCR | Measures the profitability of a home as a rental by comparing income over expenses. |

While traditional lenders focus on a borrower’s tax and income history and create harsh LTV restrictions, private lenders consider all of your properties, and the overall weighted value of the portfolio. This means that if you have a couple units that fall under the minimum requirements individually, the weighted average of the portfolio may make lenders more willing to say yes and offer a higher LTV–sometimes up to 80%.

Private lenders also have the flexibility to adjust payment options, with many offering interest-only options and shorter amortization periods on rental portfolio blanket loans. Higher LTVs and flexible payment options give investors the capital maneuverability to acquire more properties and grow their businesses.

Private lenders also have the flexibility to adjust payment options, with many offering interest-only options and shorter amortization periods on rental portfolio blanket loans. Higher LTVs and flexible payment options give investors the capital maneuverability to acquire more properties and grow their businesses.

Simplified Operational Logistics & Cost Benefits

Blanket loans simplify operation logistics by consolidating each property’s mortgage under the umbrella of a single loan with one monthly payment. With all the stresses that exist within the rental real estate industry, eliminating the headaches and logistical nightmares of having to process multiple invoices for various lenders each month is a substantial benefit for investors.

Best of all, by working with a single capital backer, you get more than a lender–you get a partner. Unlike individual rental loan lenders, a private lending partner with the ability to adjust terms and conditions can design blanket loans with cost benefits. With the right private lending partner by your side, you can unlock the flexibility, speed, and capital necessary to grow and scale your portfolio and business.

Best of all, by working with a single capital backer, you get more than a lender–you get a partner. Unlike individual rental loan lenders, a private lending partner with the ability to adjust terms and conditions can design blanket loans with cost benefits. With the right private lending partner by your side, you can unlock the flexibility, speed, and capital necessary to grow and scale your portfolio and business.

Finding the Right Rental Portfolio Blanket Loan Partner

With the right private lending partner by your side, you unlock the flexibility, speed, and capital necessary to grow and scale your portfolio and business. Finance of America Commercial (FACo) has been helping investors for over a decade to simplify operations and expand opportunities by consolidating and packaging loans for real estate rental investing.

Our Rental Portfolio Loan options provide investors:

Our Rental Portfolio Loan options provide investors:

- A streamlined asset-based approval process without no W2s, paystubs, or tax return document requirements.

- Underwriting based on a weighted DSCR average

- Recourse and non-recourse options available

- SFR, warrantable condos, townhomes, PUD, and 2-4 units eligibility

If you’re ready to expand your rental portfolio and scale your business, it’s time to partner with one of the best blanket loan real estate investment lenders. CLICK HERE to schedule a FREE consultation with a FACo expert today!

Authored by Bianca Montalvo

SEO copywriter and strategist